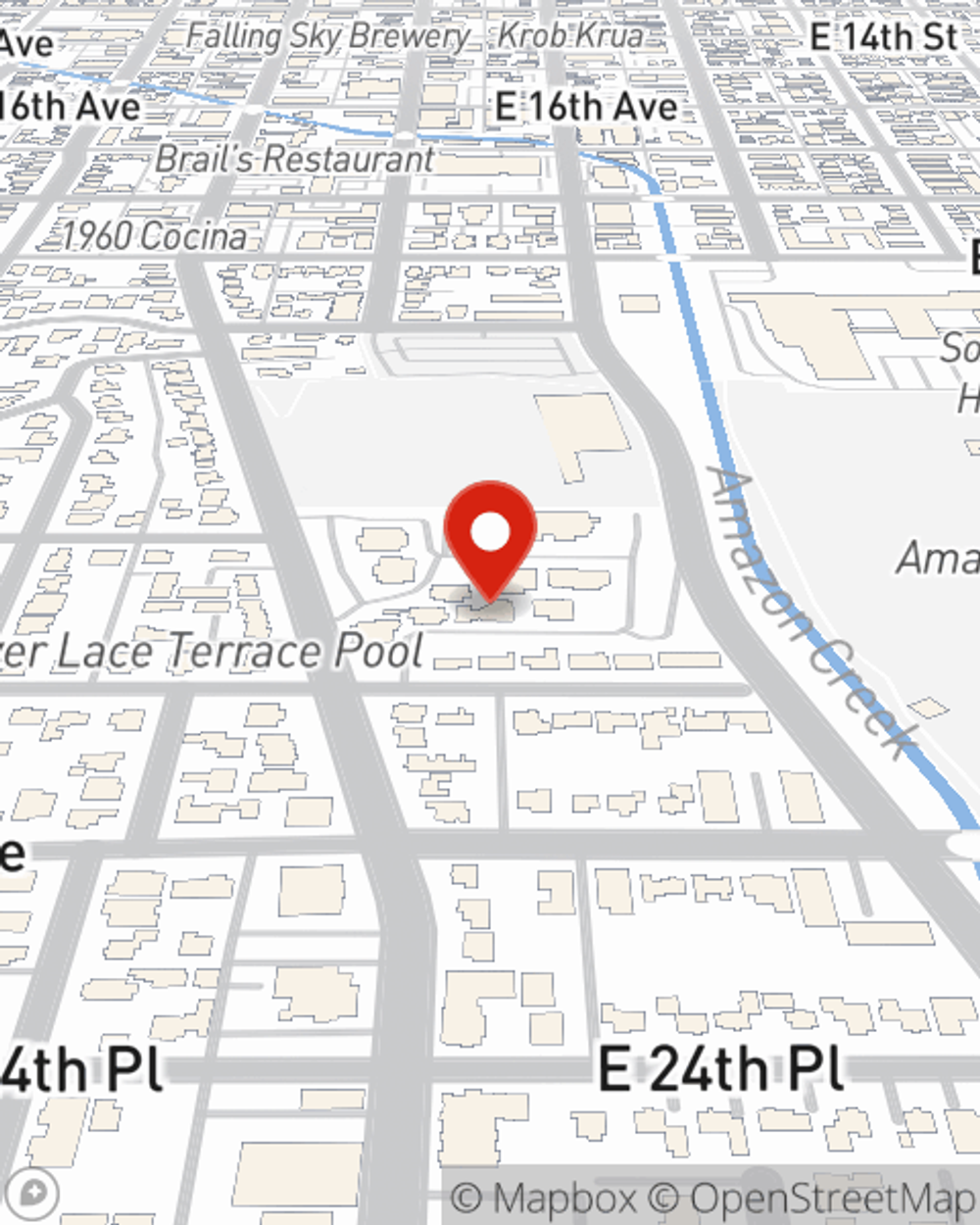

Business Insurance in and around Eugene

Get your Eugene business covered, right here!

Helping insure businesses can be the neighborly thing to do

- Springfield, OR

- Florence, OR

- Bend, OR

- Portland, OR

- Redmond, OR

- Salem, OR

- Gresham, OR

- Corvallis, OR

- McMinnville, OR

- Klamath Falls, OR

- Ashland, OR

- Newberg, OR

- Woodburn, OR

- Coos Bay, OR

- The Dalles, OR

- Newport, OR

- Lincoln City, OR

- Creswell, OR

- Gold Beach, OR

- Philomath, OR

- Astoria, OR

- Prineville, OR

- Pendleton, OR

- Cottage Grove, OR

Help Protect Your Business With State Farm.

It takes courage to start your own business, and it also takes courage to admit when you might need support. State Farm is here to help with your business insurance needs. With options like worker's compensation for your employees, business continuity plans and a surety or fidelity bond, you can feel confident that your small business is properly protected.

Get your Eugene business covered, right here!

Helping insure businesses can be the neighborly thing to do

Insurance Designed For Small Business

At State Farm, apply for the outstanding coverage you may need for your business, whether it's an ice cream store, a pizza parlor or an antique store. Agent Katie Carl is also a business owner and understands what you need. Not only that, but exceptional service is another asset that sets State Farm apart. From one small business owner to another, see if this coverage takes the cake.

Agent Katie Carl is here to talk through your business insurance options with you. Reach out Katie Carl today!

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Katie Carl

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.